Biosimilars Can Provide Big Savings in Rx Plans

What Are They and What’s Needed to Increase Usage

What is a specialty drug?

What are biologics?

Many specialty medications are biologics, which are drugs produced from living organisms such as yeast, bacteria or animal cells. Some biologics such as insulin and vaccines have been around for years. More recently introduced biologics treat a variety of medical conditions such as cancer, Crohn’s and other autoimmune diseases, hemophilia and other blood disorders, and genetic conditions.

What are biosimilars?

As patents expire for brand biologic drugs, biosimilars are sometimes introduced. Biosimilars, or biosimilar drugs, do not have clinically meaningful differences from the reference or original biologic brand product and patients can expect the same safety and effectiveness. Only minor differences in clinically inactive components are allowable in biosimilar products. Biosimilars are generally less expensive than brand biologic drugs. In some ways, a biosimilar is like the generic for a biologic, but not an exact chemical replica like a generic.

Savings from switching from a brand name biologic to a biosimilar

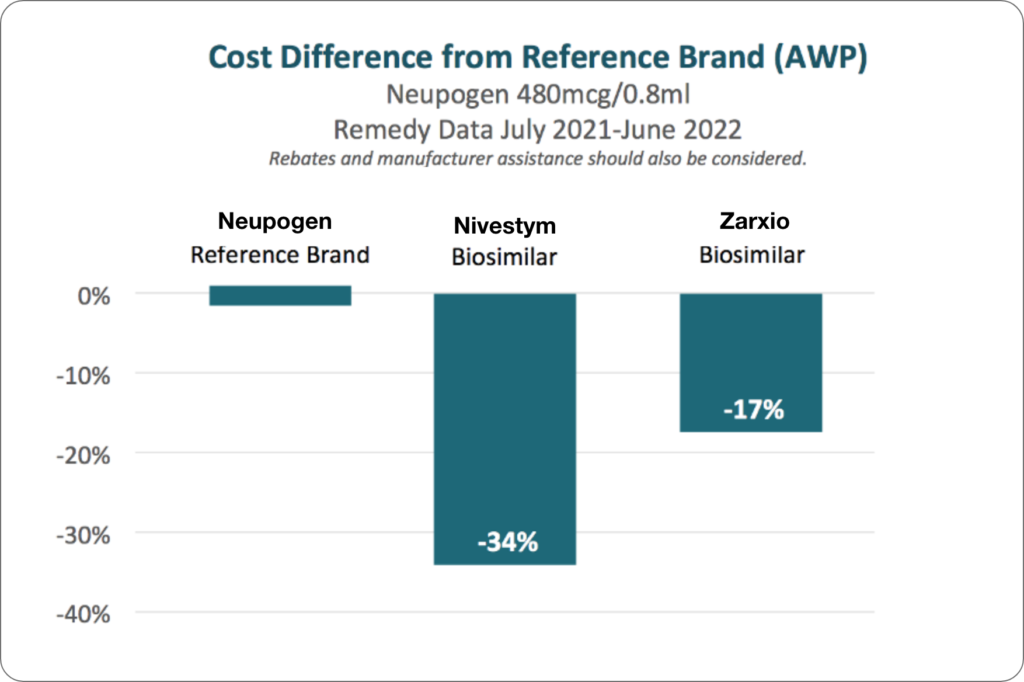

The list price of biosimilars is generally 10% to 35% less than reference brands, depending on the category of drug. For example, Neupogen® (filgrastim) is a biologic drug that stimulates the growth of white blood cells and is used to help prevent infections in cancer patients, who are more vulnerable to them because of radiation and reduced white blood cell count. Its biosimilar alternatives, Zarxio and Nivestym, are 17% and 34% less expensive, respectively. While switching from a brand name biologic to a biosimilar can reduce list or AWP (average wholesale price) costs, plan sponsors should also consider the availability of rebates and manufacturer assistance when making comparisons.

What does FDA approval look like for biosimilars?

It’s important to keep in mind that biosimilars go through a different path than a generic for FDA approval. In order for the biosimilar to be considered “interchangeable” with its brand name biologic, it needs additional special approval from the FDA to be treated like a generic, which can automatically be substituted for its brand name drug. Special approval involves clinical studies that show the drug is equally effective and safe as the brand-name biosimilar. Moreover, the clinical trials must show that switching from the brand-name biologics to the biosimilar proves no increase in health risks for the patient or decrease in efficacy of the drug.

Why are there delays in approval of biosimilars?

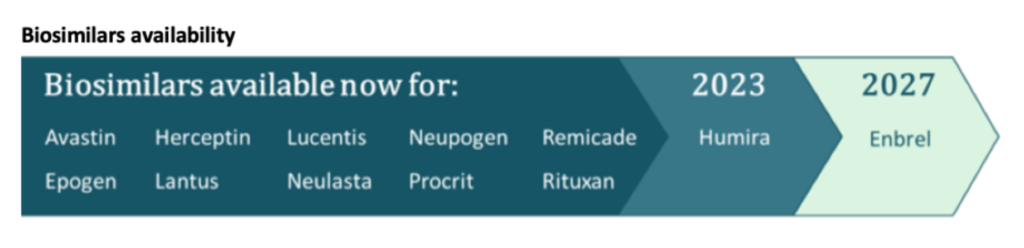

Legal roadblocks related to patents and exclusivity timeframes have prevented some approved biosimilars, namely those for Humira and Enbrel, from reaching the market. Currently, almost 40 biosimilars are approved in the U.S., but not all are available.

What is needed to increase the use of biosimilars?

- FDA approval of more interchangeable biosimilars

- Resolution of patent litigation and exclusivity rule barriers

- Alignment of product formulations

- Formulary review and placement

- Rebate considerations

- Additional education to prescribers and patients to ease acceptance of these newer options

If you are a plan sponsor, here are some steps to consider:

- Discuss with your PBM its approach to managing biosimilars; specifically, how the PBM plans for the entry of Humira biosimilars to the market in 2023.

- Review biosimilar strategies with medical benefit providers to optimize savings of biologic drug use.

- Ensure your benefit design is set to best capture savings from new biosimilar options.

- If you are a Remedy Analytics client, don’t forget to explore the use of biosimilars in your benefit plan via Remedy’s PharmaLogic® reporting.